Welcome to Corridor Consulting: Your Path to Tax Debt Relief and Resolution

At Corridor Consulting, we understand that navigating the intricate landscape of the Modern United States Tax System can be overwhelming. That’s why we’re here to guide you every step of the way, providing expert Tax Debt Relief and Resolution services that will put your mind at ease. Say goodbye to confusion and stress – allow us to help you find the most effective solutions for your tax concerns.

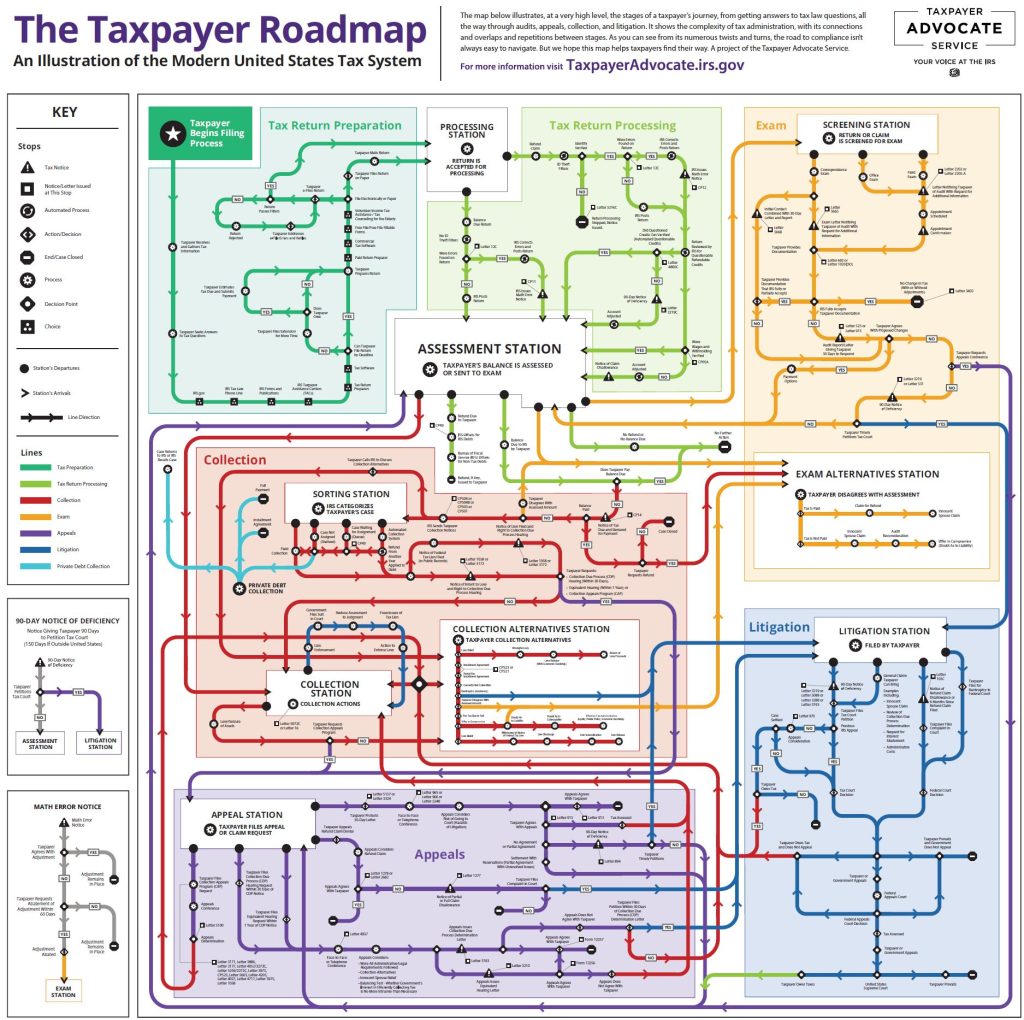

The Taxpayer Roadmap: Your Journey through the Tax System

Introducing the Taxpayer Roadmap – an illuminating illustration that depicts the complex journey of a taxpayer through the United States Tax System. From the initial questions that arise to the potential intricacies of litigation, this roadmap highlights the challenges and hurdles that taxpayers may encounter. While designed to aid taxpayers in understanding the system, the complexity of the system can be overwhelming, and for many taxpayers, it becomes clear that the best solution is to enlist the expertise of our skilled CPAs.

Why Choose Corridor Consulting for Tax Debt Relief and Resolution?

Expertise You Can Trust

Our team of Certified Public Accountants (CPAs) specializes in tax matters. With years of experience and a deep understanding of the tax code, we’re equipped to tackle even the most complex tax issues. From filing late returns, negotiating with tax authorities to developing personalized strategies, our expertise is your advantage. Because the tax code changes every year, and our skilled CPAs have years of experience in understanding those tax code changes, we have the expertise needed to defend your prior year tax positions in-front of the Internal Revenue Service.

Tailored Solutions

When you’re confronted with unfiled overdue taxes and a lack of proper bookkeeping, Corridor Consulting is here to offer the tailored solutions you need. We understand that each tax situation is unique, which is why we’re committed to providing personalized strategies that cater to your specific circumstances. If you’re burdened with unfiled tax returns, mounting tax debt, unresolved tax return issues, and other tax-related complexities, our dedicated team will collaborate closely with you to create a customized plan that aligns with your needs. Moreover, our expertise goes beyond just taxes – we acknowledge the significance of maintaining accurate financial records. If you’re struggling with overdue bookkeeping and messy accounts, our comprehensive services extend to address these challenges. Let us guide you through this intricate process, helping you regain control of your finances and ensuring that you’re well-prepared for a successful financial future.

Peace of Mind

Tax issues can cause significant stress and anxiety. Our goal is to provide you with peace of mind by handling the complexities of the tax system on your behalf. We’ll communicate with tax authorities, navigate the paperwork, and keep you informed every step of the way, giving you back your time to focus on what matters most to you.

We’re a proud Member of the American Society of Tax Problem Solvers

Contact Us Today for a Consultation

Meet Your Guide to Financial Clarity: James C. Yochum, CPA, our Virtual Chief Financial Officer. James isn’t just an expert in tax resolution; he’s your dedicated partner in achieving financial well-being. As a proud member of the American Society of Tax Problem Solvers (ASTPS), James commits a significant portion of his continuing education to mastering tax resolution. This dedication means you’ll benefit from the most current and effective strategies, tailored to navigate the complexities of the IRS with ease.

Why Choose Corridor Consulting? It’s simple. With James’s ongoing commitment to learning from senior tax resolution professionals and his active engagement in a community dedicated to tax problem-solving, you’re not just getting a service. You’re gaining access to cutting-edge solutions and a proactive approach to resolving your tax matters, no matter how complex.

If you are not presently a client, we highly recommend scheduling a Discovery Session with us. Obtaining a comprehensive understanding of your tax and financial circumstances is crucial for us to serve you in the right capacity to navigate your Tax Debt and Resolution issues. Once issues are worked through by us, it is of critical importance you continue to stay compliant with your Federal and State tax filings on an ongoing basis otherwise some of your resolutions could become void. We will help you stay compliant by monitoring your IRS account and informing you of any issues that may arise.